tax per mile rate

5p per passenger per business mile for carrying fellow employees in a. When youre self-employed and have to drive as part of your job you can claim back money for the miles youve covered for work also known as your.

Transportation Plan Proposes Business Tax But Secretary Floats Possibility Of Tolls Tax Foundation

Overall average van rates vary from 230 286 per mile.

. Approved mileage rates from tax year 2011 to 2012 to present date. The standard mileage rate for business is based on an annual study of. Standard Mileage Rate for Business.

The maximum claim is 10000 miles at 45p and 1500 at 25p for a total of 4875. 575 cents per mile driven for business use down. IR-2021-251 December 17 2021 The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 68 cents per kilometre for 201819 and 201920. 66 cents per kilometre for 201718 201617.

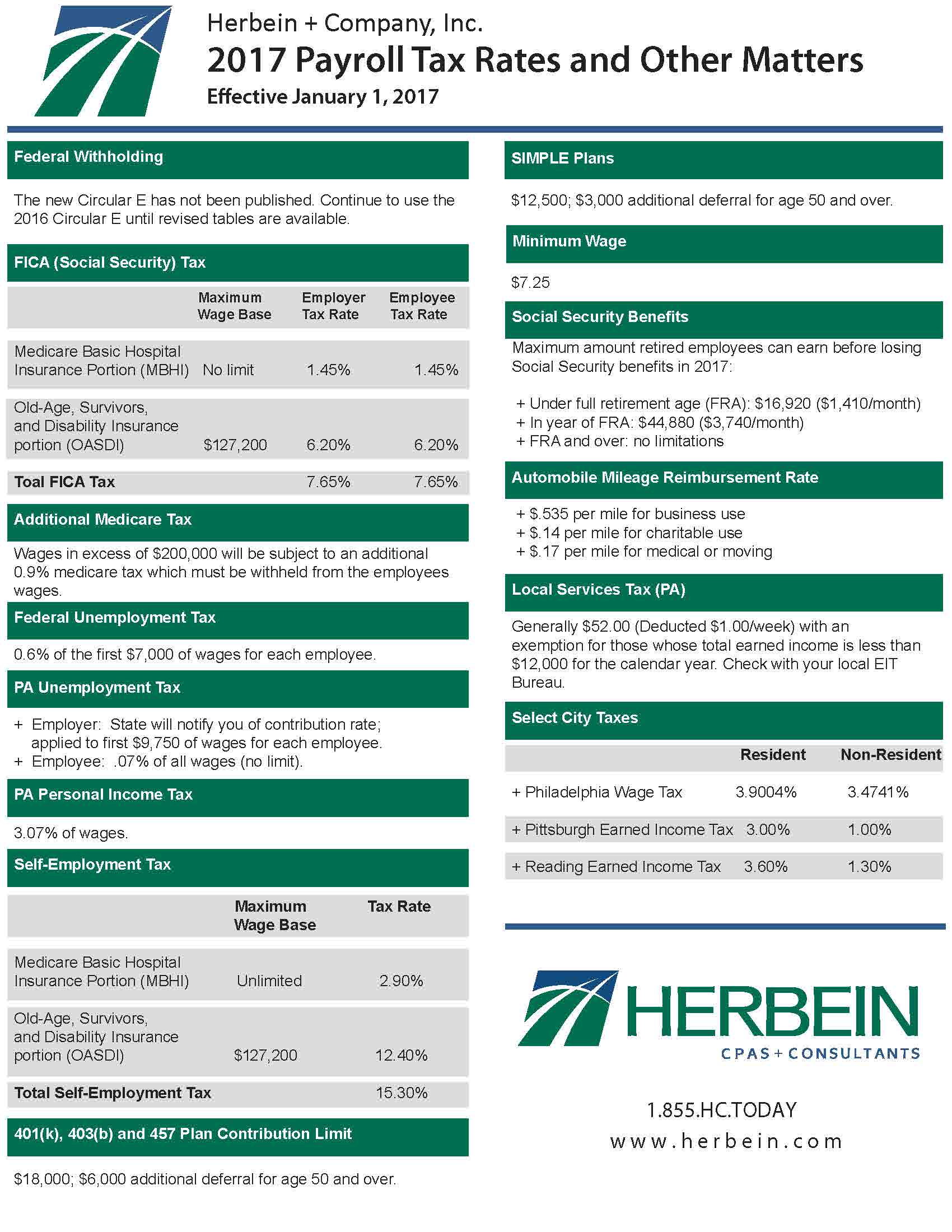

RATES EFFECTIVE JANUARY 1 2022. 2021 rate cents per mile 2020 rate cents per mileBusiness 56 575Medical or Moving16 17Charitable pu. Standard Mileage Rate.

The standard mileage rate can. 72 cents per kilometre for 202021 and 202122. How to use the mileage tax calculator.

78 cents per kilometre for 202223. A set rate the IRS allows for each mile driven by the taxpayer for business charitable medical or moving purposes. IRS Standard Mileage Rates from July 1 2022 to December 31 2022.

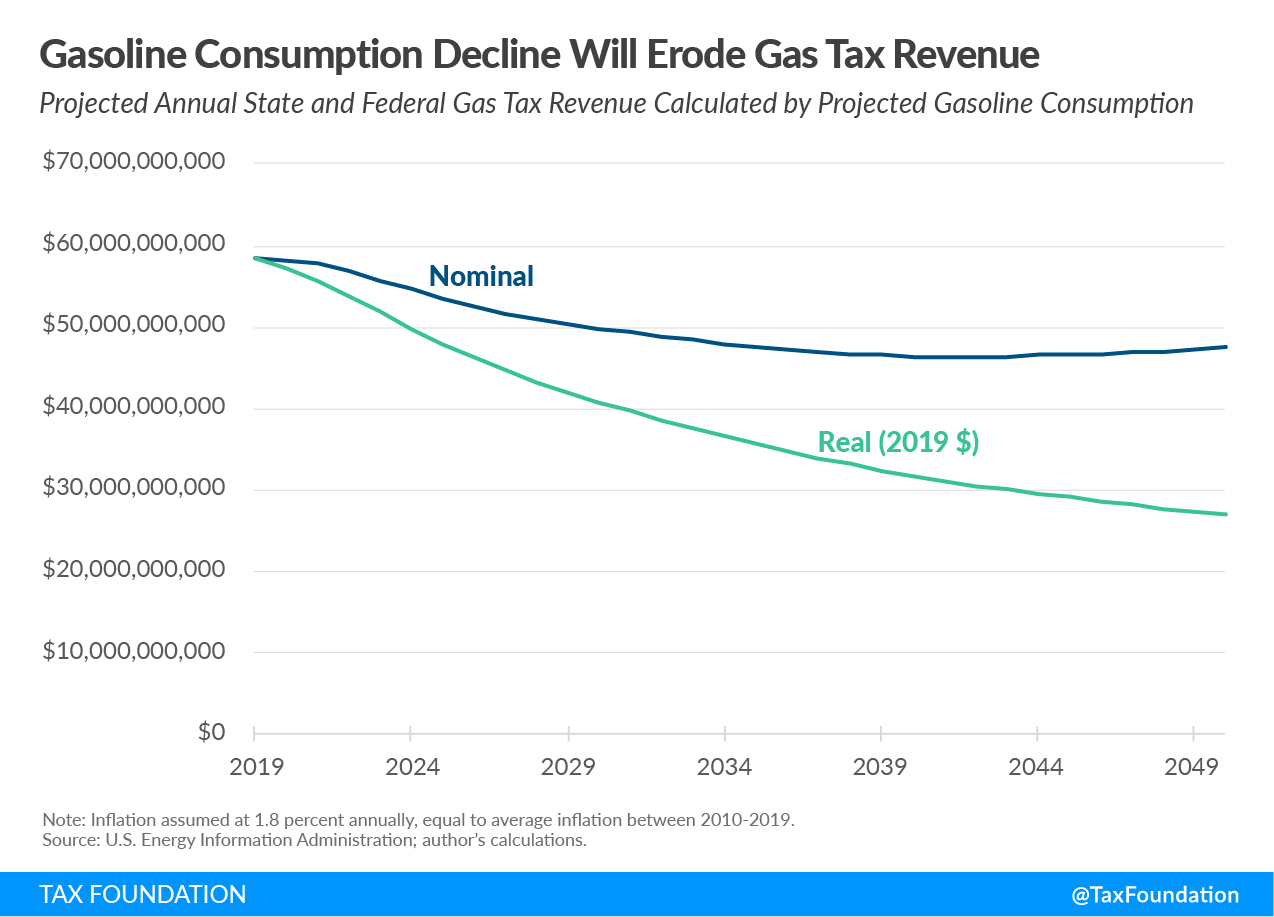

Rates per business mile. 56 cents per mile driven for business use down. A federal VMT tax rate must average 17 cents per mile to cover the highway funds expenditures.

Here are the current rates for the most popular freight truck types. First 10000 business miles in the tax year. A standard mileage rate is the dollar amount per mile imposed by the Internal Revenue Service IRS when calculating the deductible costs for business use of automobiles.

The total business miles travelled by an employee is 11500. As for Q1 Q2 of 2022 this rate is 585 cents per mile you drive while between July 1 and December 31 2022 the federal business mileage rate is 625 cents per mile the same as. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020.

INSTRUCTIONS FOR TABLE A. 22 cents per mile for medical and moving purposes. The employer reimburses at.

The actual rate per vehicle should be differentiated based on weight per. The standard mileage rates are. Use these rates only when operating at declared weights of 80000.

Reefer rates are averaging 319 per mile with the lowest rates. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. 625 cents per mile for business purposes.

Irs Announces Rare Mid Year Mileage Rate Change To Begin July 01 2022 Wolters Kluwer

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Motor Fuel Taxes Urban Institute

2022 Payroll Tax Auto Mileage Rate Changes Wright Ford Young Co

Impact Of Mileage Rates And Gas Prices On Tax Deductions Pierce Firm Pllc

Irs Raises Standard Mileage Rate For Final Half Of 2022

Irs Raises Standard Mileage Rate For 2022

How To Claim The Standard Mileage Deduction Get It Back

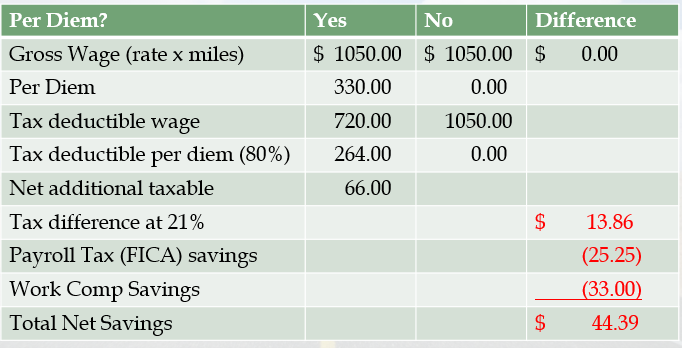

How Does Paying My Truck Drivers Per Diem Help My Company

2017 Payroll Tax Rates And Other Matters

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

Tax Per Mile Not Per Gallon The Federal Fuel Tax Is Intended To Pay By Dasmer Singh Open Road Medium

Irs Updates Standard Mileage Rate For Businesses Bennett Thrasher

Irs Announces Mid Year Optional Vehicle Mileage Rate Increase Henssler Financial

What Are The Irs Mileage Rate Amounts Updated For 2022

Chicago Congestion Tax On Rideshare Trips Takes Effect Abc7 Chicago

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

2020 Standard Mileage Rate Fort Myers Naples Markham Norton

Understanding Your Tax Deduction After The Irs Boosts Mileage Rates In 2022 Ioogo