summit county utah sales tax rate

Summit County is a vital community that is renowned for its natural beauty quality of life and economic diversity that supports a healthy prosperous and culturally-diverse citizenry. Foreign diplomats with a US.

Utah Sales Tax Rates By City County 2022

The current total local sales tax rate in Summit County UT is 7150.

. The assessors office also keeps track of ownership changes maintains maps of. Summit County Treasurer Treasurer. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables.

1 day agoPark City was the municipality in Summit County that was hit the hardest by the pandemic with revenues decreasing by around 10 between 2020 and 2021 according to a report prepared in anticipation of Wednesdays meeting. 60 North Main PO Box 128 Coalville UT 84017 Hours. State and local government entities of other states are not exempt from Utah sales or transient room taxes.

Groceries are exempt from the Summit County and Colorado state sales taxes. The office also assesses and collects taxes on business personal property owned and leased mobile homes and mobile offices. The County has contracted with HdL Companies to perform the collection and reporting of nicotine taxes to the County.

Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. Utah State and Utah local government entities must pay transient room taxes at the time of purchase and request a refund from the Utah State Tax Commission. You must apply for a license to sell nicotine products through the Clerk Recorder.

Manage Summit County Funds. The 2018 United States Supreme Court decision in South Dakota v. Park City received around 225 million in local sales tax revenues in 2020 but the number dropped to around 2 million.

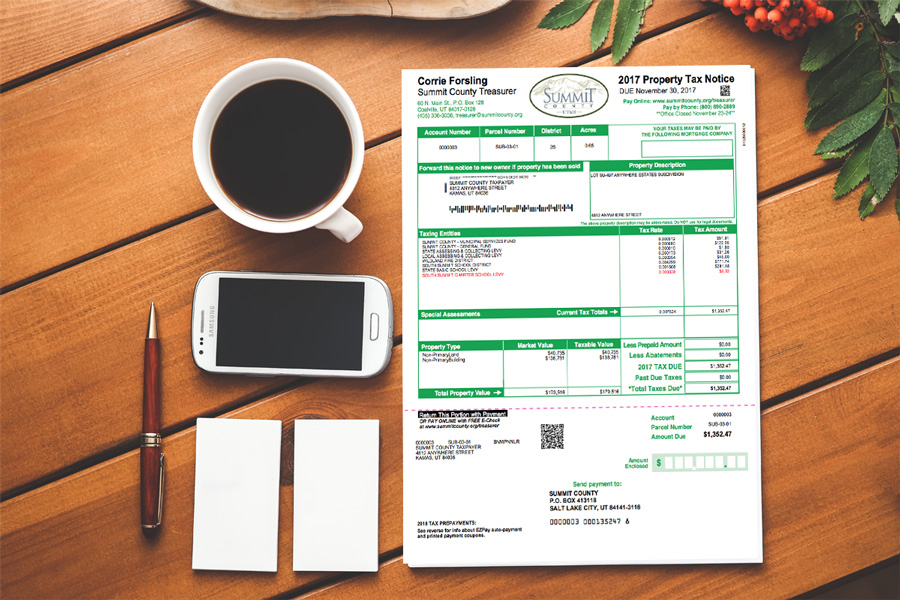

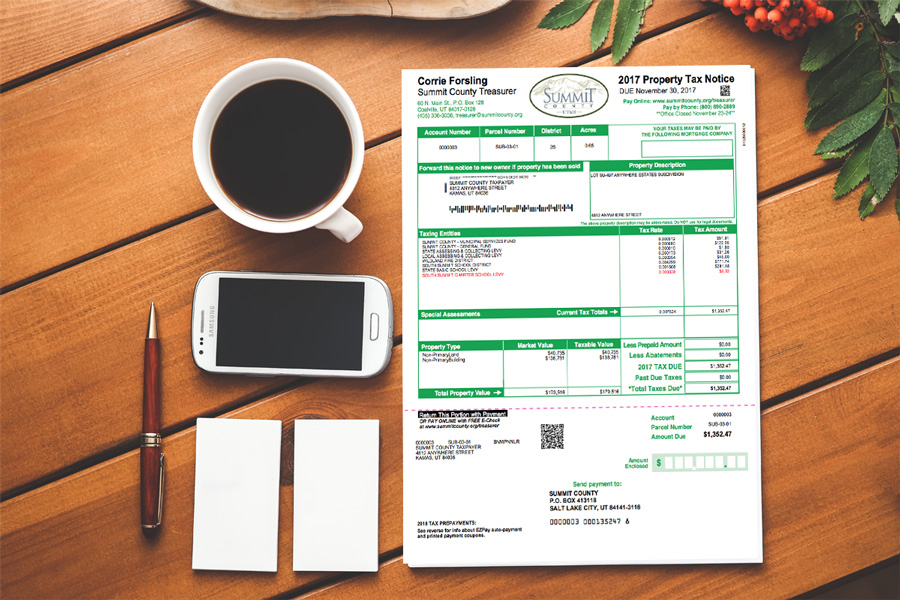

The Summit County 2021 Tax Sale will be held on. The Summit County Treasurer is responsible for the collection distribution and reconciliation of property taxes levied by all of the taxing entities in Summit County. This page provides general information about property taxes in Summit County.

The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. The Summit County Sales Tax is collected by the merchant on all qualifying sales made within Summit County. The Utah state sales tax rate is currently.

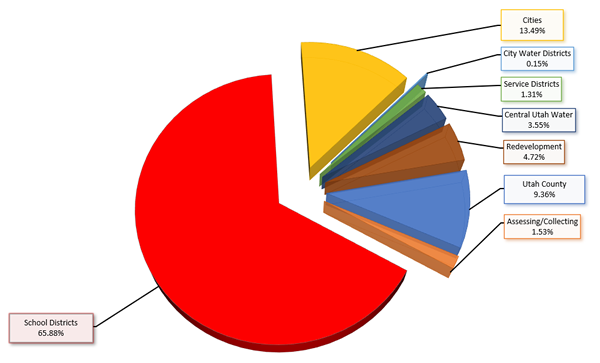

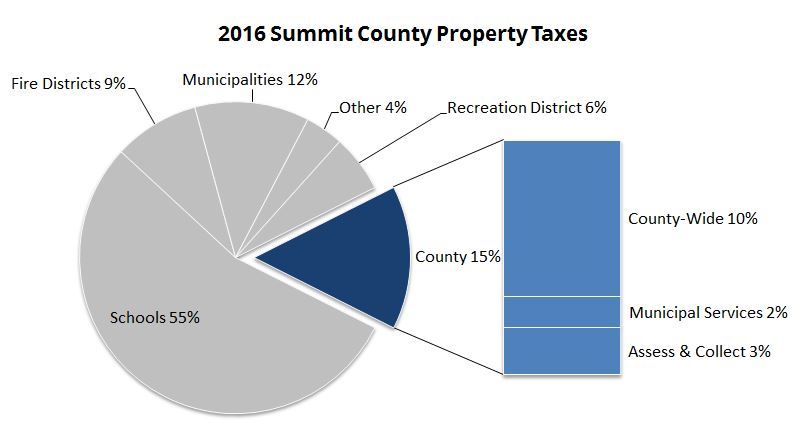

The tax rate is determined by all the taxing agencies-city or county school districts and others-and depends on what is needed to provide all the services you enjoy. 89 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions. The December 2020.

What does the Treasurer do. Mission Provide excellent ethical efficient services that ensure quality of. Report and pay this tax using form TC-62F Restaurant Tax Return.

Has impacted many state nexus laws and sales tax collection requirements. The Summit County Ohio sales tax is 675 consisting of 575 Ohio state sales tax and 100 Summit County local sales taxesThe local sales tax consists of a 100 county sales tax. Issued tax exemption or.

The tax rate is 4pack of cigarettes and 40 on all other nicotine products including e-cigarettes and vaping devices. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit. The Assessors Office is responsible for the appraisal of real property homes condos recreational parcels vacant land commercial and industrial properties.

Automating sales tax compliance can help your business keep compliant with. Click on Enter to begin searching. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales.

The Summit County sales tax rate is. If you need specific tax information or property records about a property in Summit County. The restaurant tax applies to all food sales both prepared food and grocery food.

Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. To review the rules in Utah visit our state-by-state guide. County County Public Transit.

A county-wide sales tax rate of 155 is. The Summit County Sales Tax is collected by the merchant on all qualifying sales made within Summit County. 8 rows The Summit County Sales Tax is 155.

Monday through Friday 800 am- 500 pm. Average Sales Tax With Local. The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value.

See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. Groceries are exempt from the Summit County and Ohio state sales taxes. Welcome to Summit County UT EagleWeb.

Utah has state sales tax of 485 and. 208 021 1352nd of 3143 039 003 2670th of 3143 Note. Summit County collects a 3475 local sales tax less than the 42 max local sales tax allowed under Colorado law.

Utah State Income Tax Calculator Community Tax

Utah Income Tax Calculator Smartasset

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Solar Incentives In Utah Utah Energy Hub

Corporate Retention Recruitment Business Utah Gov

Utah State Income Tax Calculator Community Tax

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

Tax Rates Utah County Treasurer

Residential Property Declaration

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Utah S Tax Burden Has Decreased Significantly In Past Quarter Century Report Says

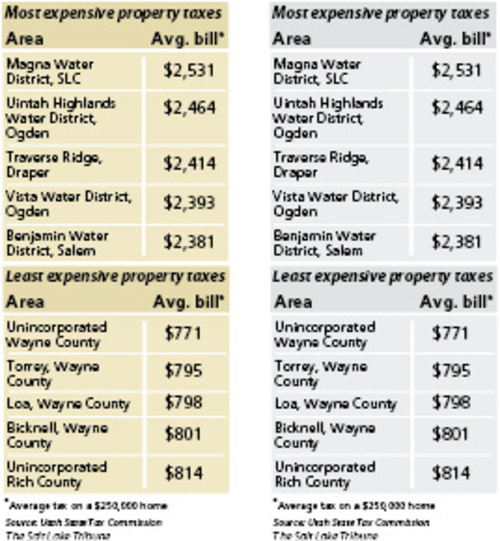

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Nevada Becomes 10th State To Ditch Tampon Tax Tampon Tax Tampons Nevada