taxing unrealized gains at death

In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when including the. In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when including the.

Tax On Farm Estates And Inherited Gains Farmdoc Daily

To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the tax.

. To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the tax rate for. Lily Batchelder and David Kamin using JCT projections estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would bring in 290. Similar to todays proposal to tax unrealized gains at death the rules were a great departure from prior law.

Is expected to lose almost 42 billion in tax revenue this year from the exclusion of capital. When the House Ways and Means Committee produced its components of the Build Back Better Act it omitted a proposal to tax unrealized capital gains at the time of a persons. To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the tax.

Taxing these gains is important because unrealized gains now account for more than half of the staggering amount of wealth of the very richest Americans those with at least. As tax attorney Robert Hightower argued in 1977 The new carryover. Proposals for Taxing Gains at Death.

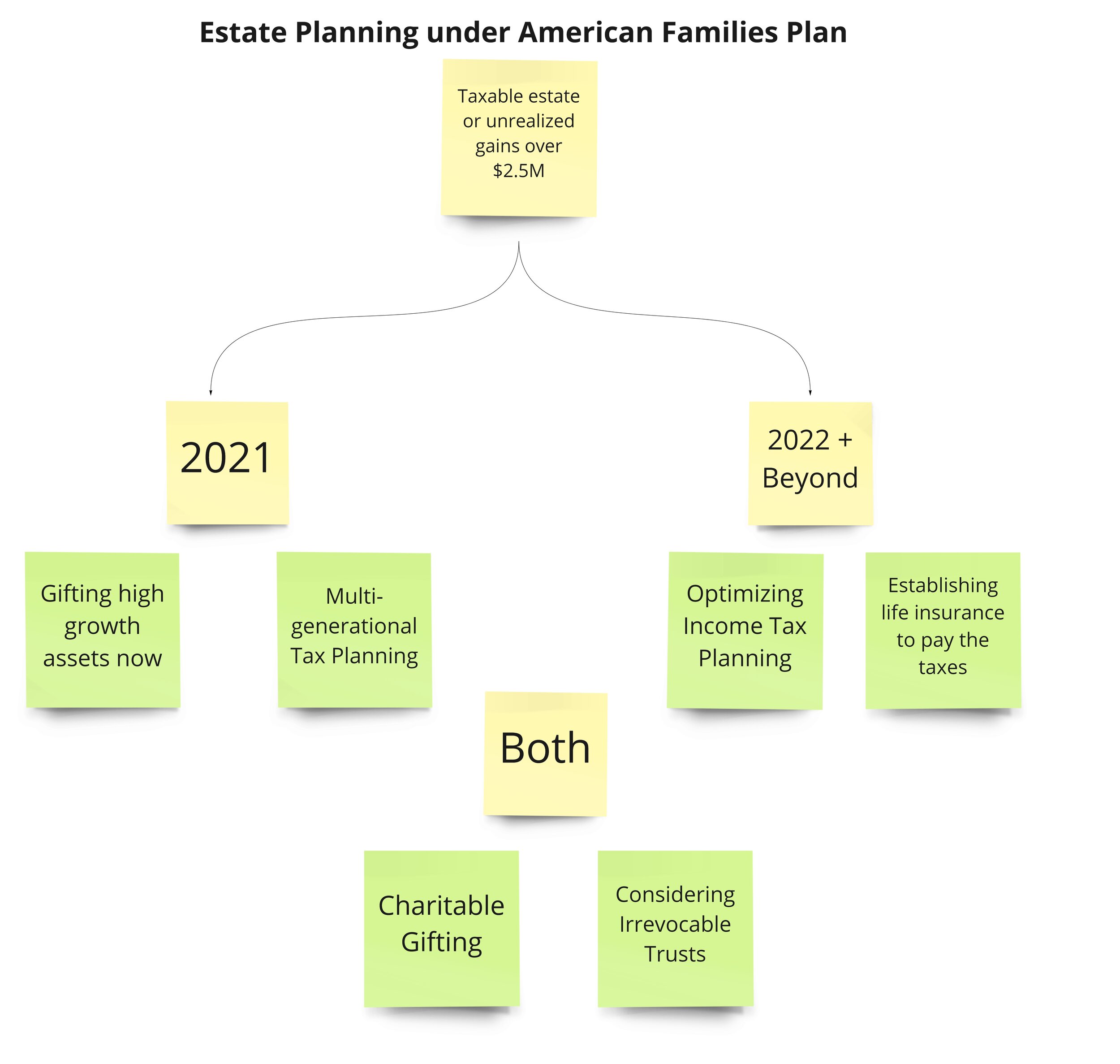

The tax would apply to 1 million of that 2 million gain due to the exclusion. Shortly after this article was completed another analysis concerning the Administrations taxing unrealized gains at death was written. In particular we compare policies in which the entire estate is taxed at death estate tax to those in which only the unrealized capital gains portion is subject to tax capital gains.

The tax proposals now before the House Ways Means Committee do not include Bidens proposal on taxing unrealized capital gains at death which Watson said signals the. Shortly after this article was completed another analysis concerning the Administrations taxing unrealized gains at death was written. Tax Treatment of Capital Gains at Death When an asset is sold that has appreciated in value such as a share of stock the gain is taxed at rates of 0 15 or.

How Biden Would Tax Capital Gains At Death Tax Policy Center

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Eliminate Capital Gains Tax With A Trust

Biden S Tax On Large Capital Gains At Death Will Catch A Few With Annual Incomes Of Less Than 400 000

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Biden S Tax On Large Capital Gains At Death Will Catch A Few With Annual Incomes Of Less Than 400 000 Tax Policy Center

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Trump S Tax Plan A New Death Tax For The Middle Class The Hill

Avoiding Basis Step Down At Death By Gifting Capital Losses

How Would Biden Tax Capital Gains At Death

Democrats Look To Impose Capital Gains Tax At Death The Hill

Ad Exaggerates Potential Impact Of Biden Estate Tax Plan The Washington Post

Democratic Ex Senator Heitkamp Biden Inheritance Tax Plan Would Hurt Family Firms

What Is Unrealized Gain Or Loss And Is It Taxed

How Biden Would Tax Capital Gains At Death Tax Policy Center

Biden S New Death Tax Hits The Middle Class While Excluding Certain Wealthy Investors

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities